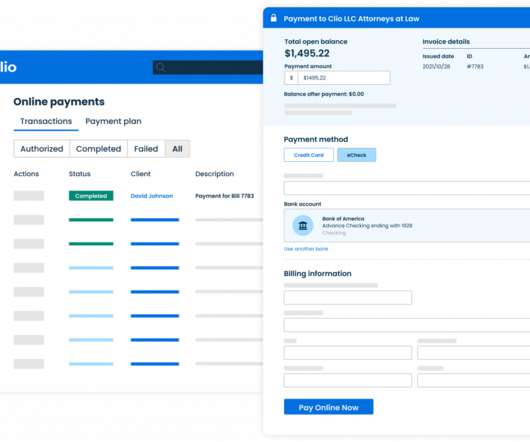

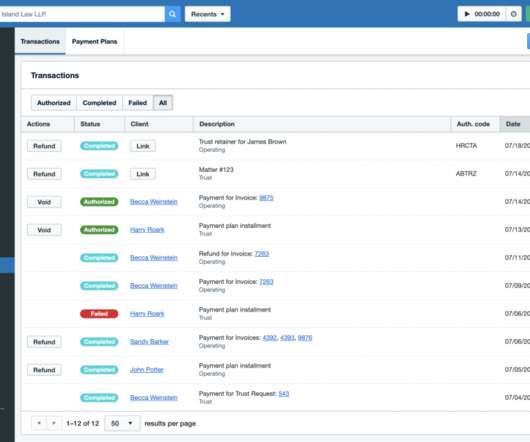

Exclusive: Bill4Time Launches Fully Integrated Electronic Payments

LawSites

MAY 11, 2021

The pandemic has made it more essential than ever before for law firms to accept electronic payments. Clients who now pay everything else online have no appetite for lawyers who require paper payments. Plus, law firms that accept e-payments get paid faster and increase their collections, studies suggest.

Let's personalize your content